You’ve built a successful business, and now you’re considering an exit?

While your business might work well for you, it might not yet be attractive for a potential buyer, strategic investor or successor.

In this article, we outline what an exit-ready business looks like. Here are the 7 steps.

- Determine your exit strategy

- Ensure an attractive revenue structure and outlook

- Optimize your financial performance

- Clean up legal and financial structures

- Make yourself redundant

- Build robust operations

- Define cultural and strategic fit

Your business is unique. You might be where you should be in some of these points, and others require work. Regardless of where you start, getting these 7 points right will ensure your business is ready for an exit.

Determine your exit strategy

There are four different types of exit strategy you might want to pursue. As a first step, you need to decide which way is right for you and your business.

The strategy you chose will impact what your business needs to look like to be ready for an exit.

The different strategies differ across these dimensions:

- The nature of cash flow during and after the exit

- Your involvement after the exit

- The nature of continuation of the business

Selling your business to a new owner

For many small business owners, this will be the first exit strategy that comes to mind.

You’re selling the business fully to a new owner, and at the same you will hand-over the CEO position to the buyer.

There are different versions of this strategy with regards to cash flow and your involvement after the purchase.

- A buyer might pay you cash for your business or there might be some form of financing granted by you (seller financing), in which you agree to be paid part or all of the agree upon purchase price over time out of the profit the business generates

- You might leave your position right after the exit, stay on board for a certain handover period or agree to act as an advisor for a set period of time.

This strategy often is best if you want to cash-out over a short period of time. When you want to retire or start a new venture, this can be an interesting way.

This strategy will be what we’re focusing on mainly in this article.

Finding a strategic investor

Another exit strategy is not selling the business fully, but rather looking for an investor that your business will benefit from in the long run. This investor will typically buy between 25% and 80% of your business

The emphasis here is more on strategic growth than on cash-out.

Scenarios in which this strategy might be right:

- You’re looking to get access to new markets, client segments or supplementary product or service offerings.

- Your business needs funding for growth.

- Your looking to expand operational resources.

- You’re not necessarily looking to cash out, but to grow your business.

Often, these deals will mean that you stay the CEO of your business for a while. Depending on the deal structure, your business might also become a business unit of the investing organization. In other cases, the investor will be looking to fully integrate your brand and operations into their own.

The cash-flow of this type of deal will often include:

- Cash payment

- Shares in the investing company (share deal)

- Or (most likely) a mix of both

Is your business exit-ready? Book a free discovery call.

Finding a CEO

Instead of selling your business fully or partly, you might also consider bringing in a successor as CEO.

The benefits are that you keep the business as an asset and revenue source for years to come. At the same time, this also means that your future cash-flow is subject to risk.

In most cases, to bring on a CEO you’ll have to give them a small to mid-sized portion of the equity.

The most difficult part of this strategy is finding someone with the right skill-set who is willing to take on the position. This person can come from your existing team, or from the outside.

Closing the business

You’ll most likely look at your business as being your baby, so this option is often the least favorite.

But there might be scenarios in which closing shop is the best way forward.

The business is highly dependent on you and there’s no short-to-mid-term way of changing this

There’s no market for selling the business (due to geography or industry).

Your business has high retained earnings so you could still cash-out by closing shop

Closing the business obviously has severe negative consequences for staff, clients and partners alike.

Lastly, it’s a technical process that will also cost you money.

What option is right for you and your business will depend on both your business and your personal plans.

Getting clear of what strategy your pursuing is important to determine what your preparation for the exit looks like.

Ensure an attractive revenue structure and outlook

For all exit strategies except for Closing Shop, your company must be attractive for the person, buying, investing in or joining your business.

A core part of this is your business’ revenue structure. Consider these three criteria to assess and optimize your revenue structure:

- Recurring revenue streams

- A diverse and loyal client base

- Growth and growth potential

Recurring revenue streams

A potential buyer, investor or outside CEO will assess your business based on a risk-reward consideration. In other words, they’re looking for maximum reward at the lowest possible risk.

A significant part of that consideration is revenue and how difficult it is to generate this revenue.

Recurring revenue is always favorable over non-recurring revenue. It minimizes the need to acquire new customers and creates predictable cash-flow.

How to improve your revenue structure

Analyze your revenue and build buckets for recurring and non-recurring revenue. If your revenue is mainly of recurring nature, it makes your business attractive.

You might find that your revenue is mainly of a non-recurring nature:

- You sell one product at a time, customers don’t need to buy your product again.

- Your service is a one-time engagement.

- You structure your client engagements on a project-bases rather than retainer basis.

If this is the case, develop ways to increase the recurring share. Here are some options:

- See if you can sell maintenance plans with your products, can supply wear & tear parts or upsell customers on add-ons

- Design service-models that keep you in touch with existing clients. Either offer small ongoing engagements to maintain or improve your initial service over time (think your paint business offers a low-cost touch up service after an initial paint job, your law firm offers a small retainer engagement for direct access to a client’s lawyer after a case- or matter-based engagement.

- Structure your engagements in a retainer structure rather than projects. This requires you to come up with ways to provide value on an ongoing basis

Building up recurring revenues takes time, and at times comes at the expense of lower initial revenues. In the mid- to long-term however, your business becomes much more attractive.

Put yourself in the buyer’s shoes; which business would you rather buy: One that creates 250,000 USD monthly revenue in sales-heavy one-off projects that depend on the owners experience, network and sales talent? Or one with monthly revenues of 150,000 USD, but in the form of long standing client contracts?

A diverse and loyal customer base

The next dimension that a potential buyer will look at is the structure of your customers or clients.

Low client-concentration

Specifically relevant for B2B business, client concentration tells you how dependant your business is on its largest client.

You calculate it by dividing the revenue from your largest client by your total revenue.

Let’s say, out of a revenue of 2,000,000 USD last year, 600,000 came from one client. Your client concentration would be 600,000 / 2,000,000 x 100% = 30%

Why is a high client concentration negative?

If your client concentration is rather high, it means that if your business loses this one client, it will be in serious trouble.

Think about it this way: If your client concentration in percent is higher than your profit margin in percent, it means that if you lose one client you’re immediately unprofitable.

Very high client concentrations exceeding 30-40% even pose a fatal risk on the continuity of the business.

Of course, this all depends on your cost structure as well. If you’re operating mainly with variable cost (e.g. using contractors or hourly staff instead of hired/salaried employees), your risk is lower as you can decrease your cost-base quickly.

But going back to the view a potential buyer might take: If too much of your revenue stems from one client or customer, it’s not an attractive acquisition target, because the risk is very high.

A loyal customer or client base

The second dimension when assessing your client base is how loyal they are. Do clients come back to you after they bought from you once?

So here, you’re not looking at recurring revenue but at repeat buyers. The more repeat buyers you have, the lower the cost of generating revenue.

How to improve your client structure

There are a few fundamental strategies you can use to create a more diverse and loyal client base:

- Acquire new clients to broaden your client base. This will reduce client concentration. If you’re looking at exiting your business, it might make sense to offer discounted entry offerings for a while to get new clients on board that you can then grow over time.

- Deliver outstanding products or service experience. Focus on client and customer satisfaction to ensure people are coming back.

Want free resources and videos to boost your business success, delivered to your inbox each month? Get the newsletter now.

Growth or growth potential

Even if your revenue and client structure is not ideal, your business might still be attractive when it has a good growth potential.

Growth potential is the degree to which your business is likely able to increase revenues over the next years. Sources of growth potential include:

- Increase in market share due to superior product or service

- Geographical expansion

- Expansion into new client segments

- Expansion of service offering or product line

- Solid positioning in a fast-growing market

How to increase your business’ growth potential

To increase your business’ growth potential, take a structured approach to identify the most promising options from the above types of growth potential.

Once identified, build a roadmap to execute and get started.

No one-size-fits all

The above dimensions will look different for every business.

Ideally you optimize your business for all three components:

- 100% recurring revenue

- Very diverse and loyal client base

- Steady and high growth.

However, in reality, that’s difficult to impossible to attain. So in reality, there can be very different profiles that different types of buyers find attractive.

Examples:

- A new tech business with very few non-recurring clients and high-client concentration, but great growth potential can still be very interesting for an investor who’s looking for an early mover advantage in a new market (think of aerospace or bio-tech businesses)

- A business without a lot of growth potential and high-client concentration might still be interesting if it holds long-term contracts with its few clients.

- A business with low loyalty and one-off revenues might still be attractive if it has growth potential and low customer acquisition costs (think of an e-commerce retailer).

- A business without a lot of growth potential, but with recurring revenue and a loyal client base will often be attractive (think of a local cleaning company).

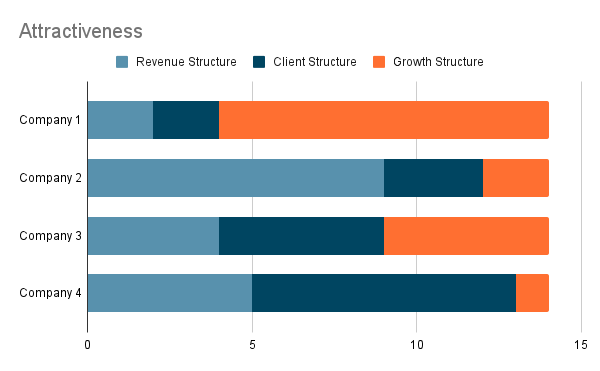

Think of these components as building blocks to a sum that tells you how attractive your business is. Here’s a total attractiveness score for the above four examples.

Optimize your financial performance

For anyone getting involved with your business, its financial performance will be a critical factor the assess when deciding for or against your business.

Strong financial performance will seal the deal, poor financial performance will in most cases be a deal breaker.

Optimizing your performance therefore is key to any good exit preparation.

Profitability

Above all, a potential buyer or investor will look for profitability. It tells them how much return they can expect on their investment.

For most buyers, Earnings Before Interest, Taxes, Depreciation and Appreciation (EBITDA) will be the key metric they look at.

It tells you how much profit your business makes before interest and taxes, as well as book value changes of your assets.

How to improve profitability

You have basically two levers to increase profits. Earn more, and spend less doing so.

Anything that helps increase revenues while keeping cost stable will help profitability. Likewise, anything that helps to decrease costs while keeping your revenue stable will do the same.

The art when preparing your business for an exit is to achieve better profitability, without harming the long-term earning or growth potential of your business.

Mere price increases or unfocused cost-cutting won’t work.

Cash-flow

For a potential buyer, it will be important that the business can finance its operations and future growth from its own cash-flow.

Otherwise, the buyer would have to either take up debt financing or add additional funding into the business out of their own pockets.

In simple terms, cash-flow describes the result of cash flowing into the business minus outgoing payments in any given period.

How to improve cash-flow

There are a few fundamental levers to cash-flow.

You can speed up your order-to-cash cycle, focusing on everything that brings in cash for any given order quicker. Examples include:

- Invoice quicker. Sending your invoices as soon as you can will cut the time it takes till you can collect cash.

- Agree on shorter payment terms with your clients

- Collect payments upfront

You can work to decrease the number of clients that don’t pay or pay late.

At the same time, you can work with keeping more cash longer in the company. Examples for this include:

- Agree on longer payment terms with your suppliers.

- Use supplier financing if the terms are favorable

Lastly, you can reduce the funds that are tied in your business. This will free up cash immediately. Here are some examples

- Manage your inventory well

- Lease items instead of buying them where it makes sense

Reporting

Lastly, a potential buyer will be looking for a business that has high transparency when it comes to the above and other financial metrics.

Specifically during the due diligence and negotiation process, having your financial metrics available instantly will create trust and allows you to get a deal.

You should be able to report on the following without huge effort:

- Profitability of the past three years by month

- Cash-flow of the last three years by month

- Gross and net profit margins, broken down by product line, business unit, client, project or market segment

- Assets and liabilities in the company

- Different cost types (staff, rent, etc.)

- Inventory values where applicable

- Billable hours

You should be able to report on any number that’s relevant to your type of business reliable, accurately and quickly.

If you don’t have this ability now, it’s worthwhile building out the structures as soon as you can, as getting reliable information requires you to have the data in the right format and attributed correctly for the time frame in question.

That means that if you want to sell or exit in three years, you should start building out a reporting system today.

Clean up legal and financial structures

I mentioned earlier that a potential buyer is looking for a good risk/reward ratio when selecting a business to buy.

Your business needs to be clearly structured and with regards to legal and financial structures and their formalization.

Legal structure

The legal structure of your business for the sake of this article includes your business’ legal entity and structure, any relationships your business has with third parties like vendors, employees and clients, as well as any open legal matters.

How to clean up your legal structure

Here’s a list of legal relationships you should look into. Please consult with your legal counsel or lawyer to do so and to add relevant aspects to the list:

- Contracts with clients: You should have clear terms and conditions in place. Any ongoing business relationship should be formlaized in a contract. Contractual agreements from clients, as well as past clients need to be documented.

- Contracts with employees

- Contracts with vendors

- Lease contracts

- Settle any ongoing legal matters.

All informal hand-shake agreements you have should be formalized and put into writing so a potential buyer has the assurance that they will continue in the same way and shape when you’re gone.

And lastly, of course any open legal disputes should be settled.

While not all of the above might be possible to accomplish, the more you can formalize and settle, the better.

Financial structure

Comparable to legal, a sound and documented financial structure will make your business a lower risk buying object.

In addition to the reporting optimization in the last section, there are some other financial aspects that need to be considered.

How to prepare your financial structure

Here are the items you should consider when cleaning up your financial structure.

- Are personal and business accounts clearly separated? Have all funds provided to the business, as well as all funds taken out of the business accounted for?

- Taxes: Are your tax records accurate? Have you filed all outstanding tax returns and paid all taxes? There should be no open matters with tax authorities.

- Your financing: Do you have open business loans you don’t need anymore? Pay them back if possible, as a debt free business in general is more attractive than one with debt.

- Back to contracts: Is there documentation of all payments? E.g., is there written documentation for all salaries, as current salaries will likely be higher than the ones you had agreed on initially in the contract with the employee.

Most of these things should be in place already, but it makes sense to tie up any loose ends.

Make yourself redundant

When someone buys the company, they know you’ll in most cases leave eventually. This raises the question: Can the company work without you.

While we will focus on operations in the next section, there are other even more important pieces to the puzzle: Your leadership team and management systems.

Strong leadership team

If you’re the only person in the company making decisions, owning client relationships and knowing the operational and commercial ins and outs of your business, chances are that your business is highly dependent on you.

Not a very attractive value proposition for a potential buyer.

Instead, they’ll be looking for other senior and experienced people inside the company that can:

- Make business decisions

- Can keep operations running smoothly and customers happy

- Can help a successor to understand and eventually develop a business further.

The core value generating functions in your business should have a person responsible for them, ideally with both operative and disciplinary oversight of the related teams.

This way, a potential buyer can be sure that your operations will run smoothly and without interruptions after you leave.

How to develop a strong leadership team

If you don’t have a leadership team in place, you should start by identifying the critical business functions that you want to delegate.

Consider the following factors:

- Which functions/departments require attention beyond what you’re able to provide

- Which functions are large enough to make it difficult for you to manage everyone directly

- What functions are strategically important for your business

With this list of functions, the next step is to identify candidates for the leadership position. The right candidate could come from internally or externally, depending on a variety of factors.

- The talent and seniority level you have in-house

- The need for outside expertise

- Your budget

- The cultural fit

Once you have selected a candidate, you need to transition them into the leadership position. For outsiders, this will mean onboarding. For internal promotions, this will include training, coaching and other measures to help them take over more responsibilities.

As a next step, it’s critical your leadership team has the tools and frameworks they need to operate autonomously and effectively. You need the right managerial tools.

The right managerial tools

Think about managerial tools as everything your leadership team uses to run their function, plus everything you use to run the business as a whole.

Strategy Execution

There needs to be a framework in place that translates your strategy into operational goals for your leadership team and the departments respectively.

These frameworks typically feature some form of goal setting or work breakdown structure, and reiterate on the same on a quarterly to yearly basis.

These tools have in common that they provide clarity to everyone involved in your business. Even more importantly, the align all activities in your organization.

Examples include OKRs or roadmapping.

Goal setting

Your strategy execution approach will determine your goal setting approach.

If you want your leadership team and ultimately your business function well, you will need to set the right goals for your organization, or facilitate the people in your business doing this themselves.

KPIs

Based on your strategy, you need to define long-term KPIs that tell you whether or not you’re successful.

While your short term goals change over time, your KPIs should be fairly stable.

Everyone in the business should have between 2 and 5 KPIs they optimize for. One KPI only might need to undesired consequences. An example: If you have your sales reps optimize for revenue only, the might “buy” that revenue with high discounts, harming your profitability.

You want to always balance KPIs, that’s why you should have two.

Make sure to align everyone’s KPIs with your company KPIs.

Decision-making authority

For your leadership team to operate effectively, the need a clearly defined set ot accountability and responsibility, alongside the authority to make decisions in their field of work.

We recommend setting up a list of topics that each member of your leadership team can decide autonomously. And couple that with a decision-making threshold as a Dollar value, beyond which they need to consult with your or get your approval.

Good communication

Your leadership team should have weekly, dedicated time together. These should include:

- Review of company level and departmental KPIs

- Update on strategy and initiatives

- Client / customer topics

- People topics

Having these things in place will ensure the buyer that he’s buying a mature organization, not a hero-based one-man show with some support.

Build robust operations

Beyond the leadership level, you need to streamline your operations. After all, a buyer is looking to buy an organization that can continuously deliver your products or services at a high quality.

The three dimensions to optimize are

- Processes

- People

- Tools

Processes, workflows and documentation

For your business to be ready for an exit, you want core processes to be running smoothly without your support.

To achieve this, there are a number of things that should be in place.

Optimized processes

Make sure you continuously optimize processes, so your business runs as effectively and efficiently as possible.

Focus on eliminating unnecessary steps like handovers, approvals, waiting time or over-processing.

In addition, you need a continuous improvement process. Your team should have a central place (spreadsheet, a dedicated place in your project management or communication tool, etc.) where they collect improvement suggestions.

Lastly, make sure that every process has a dedicated process owner, that owns the process quality and can drive improvements.

These suggestions need to be discussed regularly. Prioritize them with your team, assign responsibilities and monitor implementation.

Documentation

Core processes should be documented. This serves a variety of purposes:

- Easier onboarding

- A place to implement improvements

- A common understanding of best practices, ensuring high and consistent quality

Workflows

Wherever you can, augment documentation with actual workflows, e.g. by using a template in your pm tool. The more work you can trigger (instead of relying on people to go read somewhere how the work is done), the more efficient you will be.

In the same way as you can improve documentation of processes, you can improve workflows, bringing an immediate improvement to the work and outputs.

Automation

Monitor your tasks for work that can be automated. It’s important to acknowledge that even with automation, there has to be someone in charge for the work performed.

Automation is a tool, not a set-it-and-forget-it solution to all problems.

People

Once you have clarity on your processes, the next thing to tackle is your people management. Here are the things you should have.

An org structure supporting your strategic priorities

Define an org structure that reflects what’s important for your business. Find the right balance between flat hierarchies and manageable spans of control.

Clear operating model and job descriptions

The org structure alone won’t do much, unless you marry it with your processes.

Use a RACI matrix to define in detail, what role in your business is involved in what process in which way.

This will fundamentally define your operating model.

From that org structure, derive your job description. To bring them to live, discuss the specific job descriptions with your team and assess:

- What tasks of the target job description an employee is already doing

- What tasks they’re not yet doing but could start doing

- What tasks they’re not doing because they’re not equipped to do so.

Work on resolving the last point.

It’s important to sync your process improvement and updates with your RACI matrix, job descriptions and operating model.

Effective Recruiting and Onboarding

You want to showcase to a potential buyer, that not only your existing team is great, but also you’re able to find, attract and onboard new talent effectively.

Spell out and continuously improve your recruiting process as well as your onboarding process.

Organizational Development Infrastructure

In addition to the things already mentioned, your organization might benefit from implementing an organizational development framework. The scope of this framework will mostly depend on your size.

The components to consider are:

- A performance appraisal process, helping your team to understand how they’re doing and aligning compensation with performance

- A compensation and benefits package, helping to attract and retain the right talent.

- A learning and development framework, helping to close the gaps identified in job description discussions and performance appraisals.

- Career ladders and career progression planning, providing perspective of development to your employees, and thus increasing engagement and retention

The right tools and software

Your buyer will pay a premium if they see you’re operating on a robust tech stack that expedites work and secures high quality.

Here are the tools you want to have in place.

PM or collaboration tool

Use some form of project management or collaboration tool to manage work and ensure that nothing falls through the cracks.

This will also be the place to set up workflows and automations in many cases.

Documentation tool

Sometimes part of the PM or collaboration tool, documentation software provides a central place to document, improve and share your process information.

Reporting tool

For both financial metrics as well as performance-oriented metrics, you’ll need a tool that you use for reporting.

For software, as a rule of thumb, try to have as few tools as possible and rather maximize the use and adoption for a smaller tech stack. Every new tool produces cost due to licencses, training needs, management and complexity.

Templates

Beyond software you want to templatize as much of your work as possible. Again, a natural place to incorporate continuous improvement, having templates for core business process deliverables of client deliverables will show a potential buyer that you’re not inventing the wheel with every new iteration.

Meetings

While meetings get a bad rep, in reality they are a vital part of every well-functioning business.

Make sure to have as few meetings as possible, but as many as necessary. At least, there need to be team meetings.

In addition, your leadership team should have 1:1s with their direct reports. So should you with each member of your leadership team.

Lastly, you want to implement a smart set of functional meetings, to ensure communication flow between functions that need to communicate closely, e.g. between Customer Support and Product Management, or between Account Strategy and Project Management.

Define cultural and strategic fit

As a last step to be exit ready, you need to define what the cultural and strategic fit for a potential buyer, investor or CEO needs to be.

To do that, first work to understand your own culture. If you’re unsure, schedule a session with your team and collect values they think describe the way your business operates.

Synthesize these values into a short-list of five core values.

These are the values that you’re looking for in the buyer, investor or new CEO.

In addition, you should answer the question from the beginning regarding continuity, specifically: What would you like the company to look like 5 years after your exit.

If you have clarity about these two topics it will be much easier to determine whether a buyer, investor or CEO is a good fit.

Is your business exit-ready

This is a long list, and the degree to which the above items are relevant is individual for your business.

But working through this list, and either implementing or intentionally discarding items will help you have your business ready when the time for an exit comes.

This will help you obtain a high valuation, finding the right buyer, make transitioning out easier and will leave you confident that your baby will be able to walk on its own.